January 2023 International Monetary Fund (IMF) report forecasts that the global growth rate will plunge to 2.9% in 2023, while the global inflation rate will be 6.6% for 2023. However, the monetary regulations expect a drop in the global inflation rate in 2024 to 4.4%. While the traditional economy is on the verge of higher inflation, some crypto analysts believe that major cryptocurrencies like Bitcoin and Ethereum will gain enormous in-flow of investment, leading to an increase in their market cap. However, the price of stablecoin could be deprived of 2023 inflation.

Since 2019, the world has been into catastrophic events one after another, including the Covid-19 pandemic, the ongoing Ukraine-Russia war that created a food crisis, and the recent earthquakes in Turkey-Syria. Such events surged reciprocal impacts on the global economy, and its wave has spread worldwide.

Currently, numerous countries are going through financial instability, especially developing countries like Egypt, Pakistan, Sri Lanka, Bangladesh, etc. Also, with every passing day, the Russia-Ukraine conflict is creating a tremendous amount of heat to melt the financial superiority of the western countries.

Right now, the world is on the brink of high inflation. It affects all aspects of the economy, from consumer spending, business investment, and employment rates to government programs, tax policies, and interest rates. However, how inflation influences the crypto market is still unknown. Though based on analysis, research, and opinions from economists, one can track down the footstep of crypto during the ongoing inflation period.

So without any further ado, let’s move straight to the topic.

What is Inflation?

Inflation refers to a sustained increase in the general price level of goods and services in an economy over a certain period. Simply put, inflation is the rate at which the general level of prices for goods and services is increasing, and the purchasing power of money is decreasing.

Inflation is measured by calculating the percentage change in the Consumer Price Index (CPI) or other price indexes over a given period, such as a year. Various factors, including increases in the money supply, higher production costs, changes in exchange rates, and shifts in supply and demand for goods and services, can cause inflation. Meaning over time, the same amount of money will buy fewer goods and services due to the increase in prices.

But the question is, what causes inflation?

As per financial experts, inflation causes due to various factors, though the two foremost factors are rising input costs and increasing demand. Both these factors generate two different types of inflation.

- Cost-push inflation

- Demand-Pull inflation

An upsurge in production costs such as land, labor, capital, entrepreneurship, and the price of raw materials provokes cost-push inflation. While Demand-pull inflation prompts when the demand for particular goods or services abruptly rises.

Next, let’s examine how inflation relates to the world of cryptocurrency.

Why is Inflation Important for Crypto?

Inflation is natural and inevitable, but how it influences crypto is a big question. Some cryptocurrencies, like Bitcoin, are designed to counter inflation by simultaneously opening a door for investors to preserve their spending power.

Here are some scenarios that can help cryptocurrency climb the high market value ladder.

1. Diversion investment from the traditional market

As inflation rises, the purchasing power of fiat currency drops. In such a situation, investors could divert their investment toward crypto assets. Similar to scarce assets like gold and silver. Some cryptocurrencies, like Bitcoin, have conventional wisdom that their price rises at a certain period. This mechanism guarantees long-term investment benefits, unlike a foggy inflated market.

2. Regulation Free, Advantages of Having Decentralised Entity

As cryptocurrency belongs to the decentralized finance (Defi) ecosystem, crypto has its advantages. The most significant and foremost benefit that crypto offers is it’s out of the reach of regulators or any government. So, no centralized entity can manipulate it as they do with fiat currency.

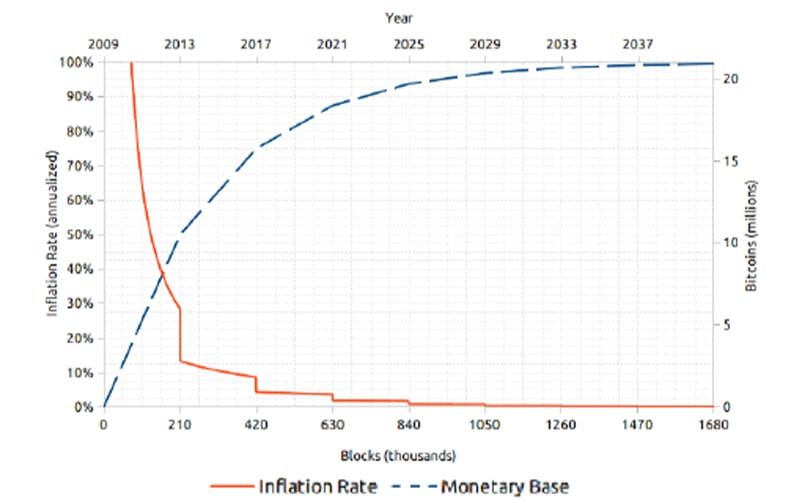

The government pumps money into the market whenever inflation prompts to boost people’s ability to spend money on goods. In the long run, it leads to higher inflation and drops purchasing power of the currency. Bitcoin has a limited supply, and no one can mine more bitcoins than the threshold supply. In a nutshell, it resists inflation at a certain point.

3. Scarcity and limited supply

Source: ResearchGate

Like scarce or non-renewable resources, Bitcoins have a limited supply of 21 million. It simply follows supply and demand logic. Over a certain period of time, Bitcoin’s scarcity and demand, and price increase.

Also Read: Bitcoin Price Prediction 2023: Will Prices Surge or Slump?

Impacts of Inflation on Crypto Firms

Inflation can have both positive and negative impacts on crypto firms and cryptocurrencies. Here are some ways in which inflation could impact the crypto industry.

1. Positive

- As inflation is rising, investors can divert their investments toward cryptocurrencies to protect their wealth and preserve purchasing power, leading to an increase in demand.

- If the demand for crypto rises, its adoption will also increase automatically.

2. Negative

- The rising price of food and energy are common effects of inflation. The ongoing conflict between Russia and Ukraine has hiked fuel and gas prices, leading to costly crypto-mining operations. On the verge of a downfall in crypto, it could spread another shockwave in the crypto community if miners lose interest in mining more crypto.

- Cryptocurrencies are already known for their volatility, and inflation can exacerbate this. As inflation rises, investors may become more risk-averse and start pulling out riskier assets like cryptocurrencies, increasing price volatility.

Overall, the impact of inflation on the crypto industry is complex and multifaceted. While cryptocurrencies may offer a potential hedge against inflation, the impact of rising inflation on the broader economy could also significantly impact the demand for cryptocurrencies and the profitability of crypto firms.

How do Different Cryptocurrencies react to inflation?

Based on the type of crypto asset class, the impacts of inflation could vary.

Digital assets backed by regulated assets

Cryptocurrency backed by fiat currency, such as USD, will directly take a hit of inflation. As fiat currency’s purchasing power is lessening, those cryptocurrencies treated as Securities could face a massive setback in their market value, like the de-pegging issue.

Digital assets not backed by regulated assets

Cryptocurrencies like Bitcoin, Ethereum, and so on would be impacted both positively and negatively through inflation.

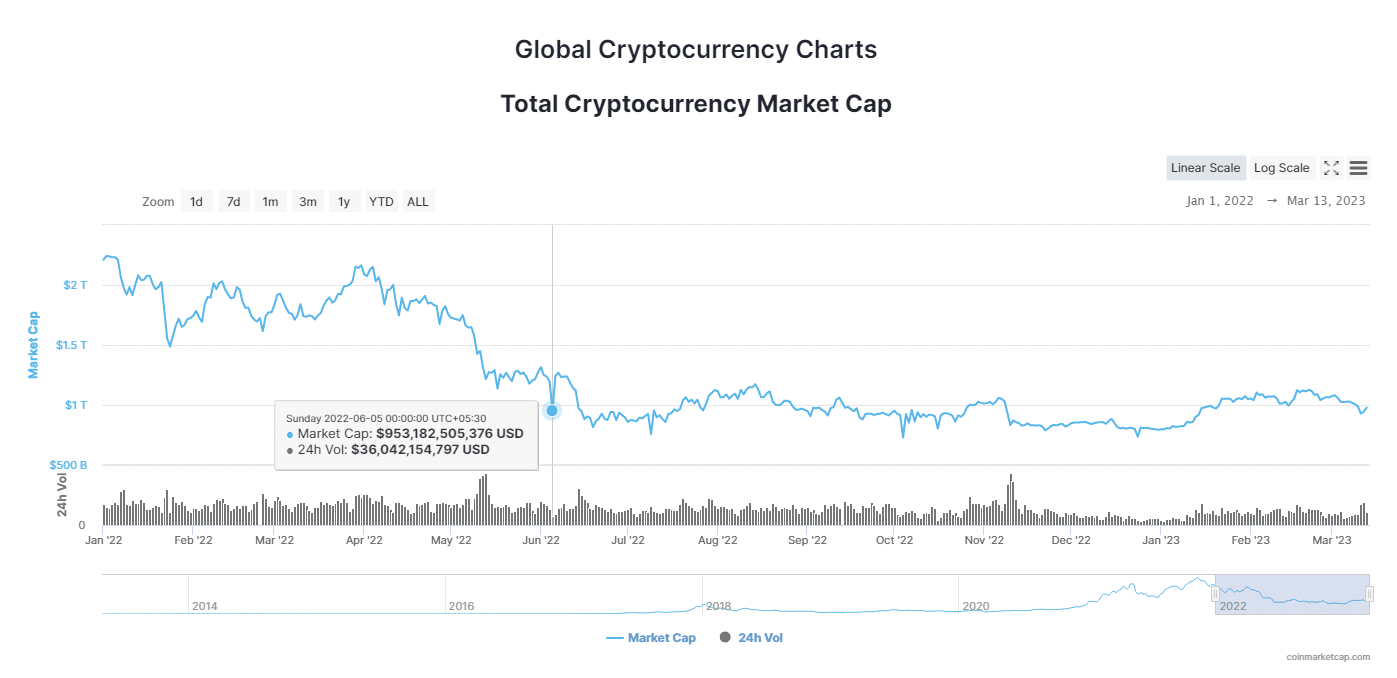

Source: CoinMarketcap

If we dive into the last year, then the overall market cap of crypto was significantly wiped out, as it fell below $1 trillion in June 2022. Major cryptocurrency, Bitcoin, lost over 65% of market value during the crypto winter, advocating its highly volatile nature. Thus, Many crypto analysts believe that crypto is entirely contagious for the global economic crisis.

Another shocking event Bitcoin enthusiasts observed was that their beloved cryptocurrency took a considerable drop after the Federal Reserve started to raise interest rates to fight high inflation, which was entirely out of expectation.

On the other hand, some crypto intellectuals refuted this claim and stated other factors responsible for crypto’s crash in 2022, including cyber attacks, rug pull, scams, poor risk management, and insolvent crypto firms that drowned millions of dollars of investment. It also caused the collapse of a myriad of crypto platforms such as FTX, Three Arrow Capital, Voyager, and so on.

Summing up

Inflation has been a nightmare for the global economy. We have seen a historical economic collapse in the wake of inflations like the great depression. But, cryptocurrency is the new financial element in the financial world, partially diluted with the regulated financial world. So, the impact of inflation on crypto is the subject matter that necessitates research to establish evidence.